Tagged: sahabatqq

- This topic has 5,565 replies, 167 voices, and was last updated 1 week, 1 day ago by Longplay55.

-

AuthorPosts

-

August 24, 2023 at 6:19 pm #26386vkhare789Registered Boarder

35 lakh shares traded through Bulk deals today. All of these deals are happening on BSE and not NSE. May be buyers don’t want to get noticed as most of us refer to NSE data.

Attachments:

3+August 24, 2023 at 6:19 pm #26388smitsatRegistered BoarderIf pref. Shares get nullify, what% SKR holding will be? A case for take over?

3+August 24, 2023 at 7:22 pm #26389SaachRegistered BoarderDear Logan, I would appreciate it if you could please share your views and guidance for the retailers on this issue of the company – BCG.

The news of ED raid on the concerned persons (in individual status) involved in the case of preferential shares – Auditor and CEO. This indicates that ED did not involve the company in this issue, which looks positive for the company, at this stage. As explained earlier that such persons must be properly and legally punished; if found guilty as explained in SEBI’s order.

Warmest regads

August 24, 2023 at 10:23 pm #26390odyseeRegistered BoarderFellow forum members and @Admin and @Logan. It is with a heavy heart and a sense of great disappointment and deep sorrow that we have to attempt to lend a shoulder to each other for support to try and navigate through this utter mess that the once deeply respected Mr Reddy has landed us all and the company in.

Over many years I have always defended the (now evident) indefensible issues staring us in our faces. My faith and belief in Mr Reddy were so strong, and always reinforced in every conference call post the sterling quarterly numbers, that I missed the wood for the trees. This entire saga of fund raising through preferential allotment, the SEBI direction on a forensic audit, and the thoughtless issue of the bonus shares for the second time did not resonate well. But were accepted because of the spectacular rise in the share price. Alas, that was too good to be true and the inevitable collapse occurred.

With the latest revelations in the second interim order by SEBI, I wish to be the first to acknowledge that we have been living a pipe dream and what appears to be too good to be true is in reality not.

But the only twig that we all can hang on to, is that the business and financial results declared are genuine and in order. After all, Deloitte has conducted a forensic audit for multiple years of every subsidiary, and no adverse comments were made on the revenue and profits. By inference, on the taxes paid in the respective jurisdictions.

Surely, OMS (audited by EY and forensically shredded by Deloitte) is worth a substantial sum, considering they also manage the North American business. Any predator, if inclined to be in this futuristic and fast growing enterprise, would surely like to capitalise on this tremendous opportunity presenting itself at this point of time, which could be a win-win situation for all stakeholders.Not that I really wish for this scenario. But that still doesn’t address my question as to why such an intelligent and diligent CEO who has done everything humanly possible to further the business should resort to such shenanigans, particularly when he ensured that the company remained debt free.August 24, 2023 at 10:51 pm #26391vkhare789Registered BoarderProbably he paid all debt so that debtors atleast wont run after him in this situation. Else, he will have no choice but to leave the country like Vijay Malya. Plan was to trick and fool equity investors.

I think, everything was part of a well thought plan as in how to fool gullible retail investors. Obviously, big investors won’t invest in the firm. Bonus issue, getting a popular investor(shankar sharma), mediamint aquisition and then cancellation, quantum computing and now AI. All of this done to lure retail investors because contrary to big investors, retail investors get fancied by these events/terms and they ignore important issues which firm is actually facing. Everything was well planned and well thought sir.August 25, 2023 at 1:31 am #26392LoganRegistered Boarder@saach, There are many possibilities and among them I can talk about few which are mentioned below. In every scenario how much ever good that maybe there’s short and long term pain and nothing would be ideal.

1) Him resigning immediately and appointing a strong chairman and a separate CEO and a good CFO who’s not a rubber stamp. Chairman to clean up the mess, CEO to look after the business and CFO to make sure that there’s no gap in financials. My suggestion for CEO would be Jacob Nizri or Etai Eitany or Bradley Cohen and Peshwa Acharya as the chairman. This will show that the people who work at the subsidiaries will look after the parent company also. This is a tough industry to be in and we need like minded people to be in CEO and chairman positions.

2) Retail investors forming an association and appointing a CEO and decide who sits on the board. This is a very difficult task and involves many things to be done perfectly. Not sure who will take the responsibility.

3) Someone big may pick up substantial stake and appoint a board and they take care of the company and its subsidiaries.

4) Nothing happens and the stock gets delisted after few years. Don’t know what happens to subsidiaries in this case.

If he really cares about retail investors who have trusted him all these years then he would make sure that the board appoints a person who has the capacity to clean up the mess that he has created.

The main reason I stayed invested and kept on investing at my personal capacity is because of 2 reasons. One is because of OMS (Israel subsidiary) and the other is because of the trust on the CEO. But my respect for him and the trust I had on him started reducing after forensic audit notice and I lost almost all the trust when he and other promoters lied about their shareholding. Israel is a technology hub and is the next Silicon Valley. The future is in technology and technological transformations and Israel will be at the forefront along with Silicon Valley.

The CEO wasted a very good opportunity. He could’ve driven the company without committing these frauds.

Like I said in my previous post that the current situation is like what happened with Securekloud and today similar thing happened. In that company too, ED raided the CEO’s house and he was arrested later. I thought ED or authorities would take actions once the company submits its response and then SAT would give orders but it’s good that they took action now itself.

That company’s CEO was removed and someone else was appointed as the CEO. Securekloud’s subsidiaries are doing okay and business is running as usual. Its subsidiary (Healthcare Triangle Inc) is listed in the US markets. I don’t know much about its business as I checked only the events related to forensic audit and subsequent events.

August 25, 2023 at 5:28 am #26393AdUpRegistered BoarderIt all hinges on the authenticity of subsidiary earnings. We can probably rely on them as it is stamped by one of big 4. As long as these earnings are true, and if the company takes right steps from now on, there might still be some hope left. As Logan points out above, there are some similarities between this and Securekloud’s episode, but the outcome might not be same. When it comes to BCG, nothing can be predicted.

I have a feeling that SKR fell for investor pressure. He probably felt he had to increase promoter shareholding and bring some reputed name as an investor both of which he absolutely didn’t have to. Instead of increasing promoter shareholding, he could have increased trust with the markets and that could have had much higher effect than this mess.

All these nightmares started with the second bonus shares, and probably slightly earlier. The best thing now for the company is to get rid of him ASAP (if not already done internally), and as Logan suggested, to bring someone with reputation onboard. The question now though is, if anyone reputed enough will take the risk of coming onboard with all these events? Option 1 from Logan above sounds like a good plan.

I am eagerly looking forward for the board meeting outcome on Sunday.

August 25, 2023 at 5:42 am #26394nitin_asceRegistered BoarderI think SKR is ready for this. He indicated ghis in q4fy23 concall that company is ready with the plan and as far as I recollect it was also mentioned alternate leadership is also planned.

I think he already had an inkling that SeBi will bar him.The Issue is promoter despite being barred still may have significant influence over comapany’s business.

The key issue still remains the shareholding and once it is sorted whether promoter accumulates it to his desired level or any other company buys it only then share price will grow.

August 25, 2023 at 11:01 am #26395whySharesRegistered BoarderTension regarding BCG continues……

But some comforting facts.1. First day after the bombshell news, BSE+NSE trade volume was over a crore, second day it was over 50Lakhs and today the third day – let us wait and see, already at 10:50am crossed 12 Lakhs.

2. Posts in X (erstwhile Twitter) postings quoting 2012 performance of Ybrant Digital (the name of BCG in 2012)

Quote:

“As #BCG #Brightcom board is to meet to give effect to Sebi’s order.

Lets see below statements by earlier CEO of our israeli subs before acquisition and 2012. So lets not fall prey to narrative. Business is authentic. We used to do 9 billion impresions/month in 2007.”As #BCG #Brightcom board is to meet to give effect to Sebi's order.

Lets see below statements by earlier CEO of our israeli subs before acquisition and 2012. So lets not fall prey to narrative. Business is authentic. We used to do 9 billion impresions/month in 2007. pic.twitter.com/tu8Q86U0uT— Mayur (@mayur78900) August 25, 2023

August 25, 2023 at 11:38 am #26397radhutheoptimistRegistered BoarderLogan ji, question to you. As per the rule of the land, when full amount is not paid within the stipulated time a warrant cannot converted. If done already the share and subsequent bonus need to be cancelled. This is the rule and I am sure SEBI will insist on it.

Now, most of the FPIs and other individuals who bought the warrants have already sold.

BCG in turn can cancel the existing shares of individuals and FPIs which are not yet sold.

However, SEBI may insist on BCG as a company to buy back the shares from the market and cancel it subsequently. It may put the onus on BCG to collect the balance amount. There is a possibility of FPIs going scotfree and financial implications falling once again on BCG. BCG may have to do the same with reverse split kind of process to nullify the effect and it’s reserves may reduce to that extent. And they may put amount as account receivable from FPIs.

Atleast SEBI has woken up now and put a hold on all 22 warrant beneficiaries. I don’t know the quantum of holding of these entities.

My point is, we are looking at some 80 crore shares getting reduced and the implication of this. I consider that as a positive way out.

They can come out with some kind of reverse split process as happened in 3i Infotech to nullify the effect of warrants and subsequent bonus shares.

Am I right in my thinking?

August 25, 2023 at 12:31 pm #26398SaachRegistered Boarder@Logan, dear I appreciate so much for your clean and clear explanation manner as per my expectations. In fact, my position is also not very far from your reasoning to be involved as an investor in this company. A last option is left with the retailers – just to wait and watch, patiently, for the outcome of forthcoming meeting on Sunday and then act accordingly. Once again, thank you so much. Warmest regards.

August 25, 2023 at 1:14 pm #26400LoganRegistered Boarder@akkithegrt, I’m not sure on that but Jacob Nizri sits on the board of OMS (Brightcom) as per details on their website. He is mentioned as the president and other members of 44 Ventures are the remaining members of the board.

Also, in the Brightcom ownership document that’s available on BCG’s website, it is mentioned that Jacob Nizri, Suresh Reddy and Vijay Kancharla (all the 3 names are written like how you would pronounce their names in Hebrew) as the company’s directors and that Kost Forrer Gabbay and Kasierer as CPA (Certified Public Accountant)

In my opinion, Jacob Nizri would be the ideal candidate as CEO but not sure whether he will consider it as he will be tasked with cleaning up all the mess created by the current CEO. Maybe an interim CEO would be a better option to clean up the mess and they can appoint an ideal candidate once everything is fixed.

@radhutheoptimist, I’m not sure on that as I’m seeing this type of issue for the first time. I could’ve commented if something similar had happened with other companies. It’s best if you can check that with sebi.August 25, 2023 at 4:35 pm #26403akkithegrtRegistered Boarder@Loga Thanks.

Sunday’s meeting will be historical.If SKR comes out with funny answers then all investors should better go to Hyderabad and raid all SKR properties and ask him to sell that and pay to investors.

2+August 26, 2023 at 11:35 am #26405whySharesRegistered BoarderShankar Sharma writes on X (Twitter) about his investment in BCG

(1/n) Brightcom: The Parson ka Saag-a

By

Le Grand Fromage

(Writing sense. At least, some of the time)Ok, bachha party, tayyar ho jao..As Dharam Paaji said famously " Gaonwalon, is kahani mien action hai, drama hai, comedy hai, tragedy hai". This is a…

— Shankar Sharma (@1shankarsharma) August 26, 2023

4+August 26, 2023 at 2:53 pm #26406vkhare789Registered BoarderIn summary, SS meant that reddy is even more shameless than a pornstar

9+August 26, 2023 at 8:29 pm #26409vkhare789Registered BoarderAugust 27, 2023 at 7:17 pm #26890akkithegrtRegistered Boarderany updates on Board meeting,any hint is it going to happen or not as skr is absconding…!!!

3+August 27, 2023 at 9:03 pm #26963Test

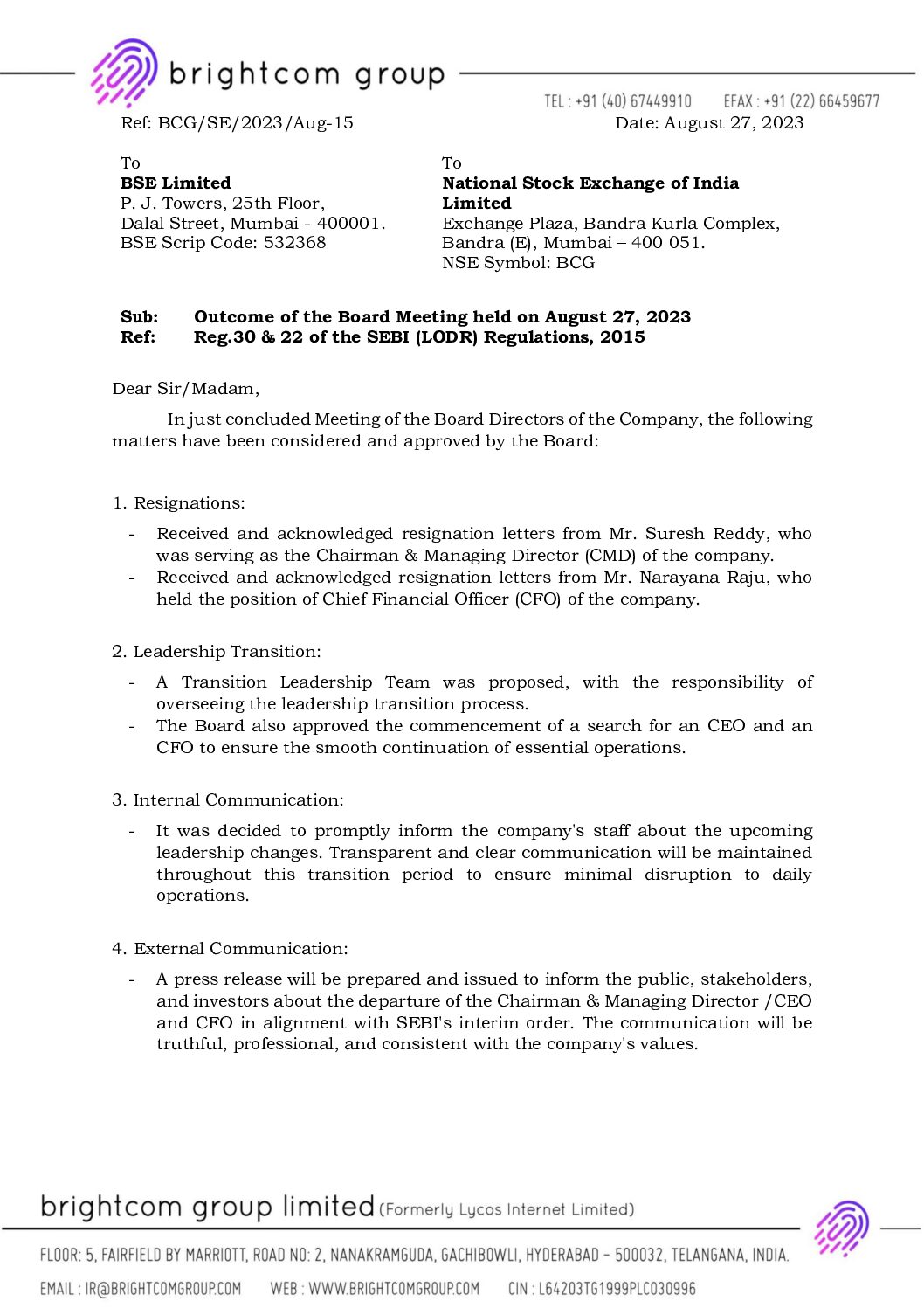

1+August 27, 2023 at 10:18 pm #27005AdUpRegistered BoarderMuch awaited outcome. SKR and Raju both gone. New management to take over. Honestly, this was an expected outcome, but it is still reassuring to see board taking steps in the right direction. Next step would be to see the interim ceo, and of course the next ceo and cfo.

Attachments:

10+August 28, 2023 at 4:04 am #27018LoganRegistered BoarderI never in my wildest dreams would’ve imagined that the CEO would do something like this. All the shareholders had trusted him and the management for years but we feel betrayed by their actions. His case is like someone shooting themselves in the foot for stupid reasons. He could’ve achieved so much honestly and legally but he chose the wrong path. It’s good that both the CEO and CFO resigned. If they didn’t resign then a different type of drama would’ve started.

The board should start cleaning up the mess and should start looking at the interests of 5 lakh shareholders who have supported the company through thick and thin and who have put their hard earned money (many have invested their life savings).

There’s nothing to lose for the board and everything to gain. If they fulfill their commitments and roles then they’ll be the saviours of retail investors. Hope they appoint new CEO and CFO at the earliest and follow all the regulatory guidelines.

-

AuthorPosts

- You must be logged in to reply to this topic.