Tagged: Call Girl Rishikesh

- This topic has 5,566 replies, 167 voices, and was last updated 2 weeks, 2 days ago by Logan.

-

AuthorPosts

-

January 29, 2024 at 2:51 am #27490odyseeRegistered Boarder

I feel so utterly helpless and disappointed at the way things have turned out. So many loyal and supportive investors, who for years together backed Mr Reddy to the hilt, and believed so fervently in the prospects of BCG , are now floundering in a state of shock and despair at the disgraceful turn of events in the last many months. Many of us, including Logan and Saach, committed large sums of our savings to what has durned out to be a cruel joke on unsuspecting retailers. And the tragedy continues as no clarity has emerged even after months of investigation by the regulator and multiple promises made by the current board of the company to do the maximum possible to ensure that the interests of the retail shareholders are protected. No executive director, no CEO, no CFO, no AGM, no EGM called to approve the appointment of the new statutory auditors, quarterly results not declared- the list is long and endless. And yet, we still cling to that sliver of hope, that someday, somehow things will get better and BCG will survive and thrive, and we will all get some positive payback for the suffering bestowed upon us by people we had once trusted and respected. God willing!!

January 30, 2024 at 5:24 pm #27495LoganRegistered BoarderI want to make it clear that I’m not angry/sad/disappointed because the stock price is not going up whereas other stocks have rallied, I’ve seen this before not only in BCG but many other stocks where they’ve underperformed when others are doing well but later do well. I’m angry/disappointed/sad because of the lack of actions from the company/board and also because they are still dependent on SKR for taking any decision and that SKR back stabbed us and doesn’t care about us.

I’ll be more disappointed/sad/angrier if SKR tries to separate OMS from BCG. Ad tech companies rely on technology but equally or sometimes more important is the human factor. You can’t replace someone like Jeff Green (of TTD) and expect TTD to outperform others. Similarly, it’ll be hard to replace the Israeli talent of BCG/OMS.

So, my concern is SKR starting a new company and taking away the talents from OMS. As I read from knowledgeable members that OMS can’t be separated from BCG, but it still can be in a dishonest way by taking people away from it. Anyone can start a new company but it’s the human factor that differentiates the ad tech companies. Years of connection with clients, know how of the technological trends, talent recognition can’t be replicated easily and that’s why many companies fail in the ad tech industry and it’s hard to compete in the industry.

January 30, 2024 at 6:03 pm #27496LoganRegistered BoarderThank God, they’re appointing an executive director on the board (the meeting is on Friday).

Finally the board woke up and it’s a good step. He’s also from IIT, Kharagpur and has been working in the tech industry.

January 30, 2024 at 6:14 pm #27497SaachRegistered BoarderDear all, so cheer up and keep fingers crossed. This ray of hope could be the opening of new era. Warmest regards.

January 30, 2024 at 8:24 pm #27498akkithegrtRegistered Boarder@Logan Sir and @Saach Sir, I hope you both have a great, healthy, and wealthy retired life.

Finally, something positive has arrived at BCG.

We investors hope that BCG will grow with new management and SKR will support them in background.

February 4, 2024 at 8:19 pm #27516LoganRegistered BoarderMeta (Facebook) is paying its first dividend. There are many opinions and observations on this but I’ll stick to only two. One is it shows the company’s financial strength and confidence and other is that it shows it has plans to grow even while paying dividend. Not only that but it plans to buyback $50B worth of shares. Next Google may start doing the same. Google has close to $150B cash with which it can easily buy TCS (our country’s second largest company by market cap).

Big Tech companies are getting stronger everyday and it’s really hard for smaller companies to compete and SKR shot himself in the foot and is making us suffer at a time when we needed stability in the company the most. The main reason I supported SKR before was because he’s good at adapting to changes in the industry and has a good grasp on technological trends but his evil side made him take things for granted. He saw the trend in audio ads and adapted well, he saw Quantum computing getting more traction so he wanted to invest in that field but all those will be of no use now without proper leadership in the company.

If everyone remembers, I always wanted the company to appoint a top 4 auditor instead of paying dividend. If they had done that, SKR wouldn’t have taken things for granted and he’d have feared the auditors. Appointing a top auditor is a good step in making the governance (financial side) better and for the operations side (and also financial), it’s having a strong board. It’s a welcome move to appoint a whole time executive director and new independent directors on the board but the sad part is that still it looks like the company will be under SKR’s influence. I don’t know when things will get better for us.

February 6, 2024 at 10:46 am #27522drpramRegistered BoarderSir,

I have the following doubts..

SEBI has found some mistakes in the company and asked the CEO to step down..

Soon all the board members on responsible positions resigned one by one as if it is not their kid to nurse..

Now just now a person has been appointed as a director and his position is yet to be authorised..

In this circumstances what is the role of regulatory body like SEBI..

A listed company is trading on a daily basis has nobody on board..

I don’t know who will answer the queries of investors? Who has the power to release the financial??

When mo responsible person is there , whom do we blame or question??

Isn’t the responsibility of SEBI to take over or appoint some management sothat a listed company can at least function to its minimum responsibility..

In these scenario what is the responsibility of SEBI..

The learned members please respond..February 14, 2024 at 10:19 pm #27543LoganRegistered BoarderIt’s good that the board is updating us regarding important things but if there are no actions then those notifications will lose significance. They shared a similar update on the same items on September 1st and we all know what the progress is.

If the result is not favourable to SKR (in SAT) then he will appoint a dummy CEO and a CFO and drag things for years and he will have (in)direct control.

We boarded this ship trusting the captain thinking that he would take us to a good place but it turns out that the captain is a pirate and we’re in the middle of the sea in stormy waters.

Many other ships went past us but we didn’t jump to them and we are stuck here. Now it’s too late to jump and our only hope should be that this should not be a sinking ship and that the fault is only with the (pirate) captain and not the ship.

February 23, 2024 at 2:58 pm #27557LoganRegistered BoarderSecurekloud’s (formerly 8K Miles) previous CEO/chairman/promoter was arrested last year by ED but two weeks back the ED case was quashed by the HC of Madras and SC agreed with the HC judgement.

He faced similar charges to SKR and in fact the company had shown fake revenue, profits and assets for years and had gone through forensic audit also. Sebi imposed penalty and banned him and others for few years.

This is how these rich people will get away. They’ll delay things until the end but in all this time the people who suffer the most will be the retail investors. They’ll delay and delay till the tide turns in their favour as they have resources to survive but we will invest our hard earned life savings which will be very important for our future.

Now MCA has decided to probe BCG and SKR will again put shareholders into trouble instead of agreeing to the frauds he has committed. One person is destroying the health, peace, dreams and hopes of lakhs of shareholders and their families.

Looks like the chances of BCG drama ending soon is not in sight and it may take years.

February 24, 2024 at 5:42 pm #27558odyseeRegistered BoarderThank you for your post @Logan. This action may not be too damaging as it was brought about by the pressure being exerted by a large group of retail shareholders to expedite the declaration of the financial results of BGL. This could assist in the timely completion of the audit as well as the final steps required for the holding of the AGM for the FY ended 31.3.2023. We should bear in mind that SEBI must be under severe pressure to complete its probe and come out with a final report on the SCN issued last year in August. We also have a date for the SAT hearing in early March, as well as the expected declaration of the Sept quarter results.

I believe that the momentum is now building up for some resolution to this whole mess, despite the attempts to drag on matters endlessly.

Justice for the long suffering retail shareholders must prevail, and the regulatory authorities are hopefully well aware and conscious of that.

The MCA action could well spur the company to give up its lackadaisical approach and cooperate fully in every aspect. The Deloitte forensic audit submissions would come in handy for them.February 24, 2024 at 7:20 pm #27559SaachRegistered BoarderDear @Odysee! Last paragraph of your message is well explained and positivity in the matter could be seen by the expeditious action from the management of BCG. I agree with your both points under these conditions, definitely, Deloitte forensic audit submissions could be a very useful tool for MCA. Simultaneously, do you see any possibilities of reversal and cancellation of those allotments of Warrants of 22 parties! Warmest regards.

February 25, 2024 at 10:32 am #27560odyseeRegistered BoarderThank you for your comments @Saach. To the limited point regarding the PW mess, all warrants were converted into ordinary equity shares and hence cannot be distinguished from other shares. But we have two distinct scenarios here. The allottees who have held on to the shares would have to show proof of payment made to the company to be able to retain the shares. If not, then SEBI may well initiate a process to eventually annul those shares unless the regulator provides an opportunity for topping up payments toward the partly paid shares. I am not aware how that could be done within the existing rules and prevailing laws.

Where the shares have been sold in the market, then again the same principle of proof of payment required; otherwise the original allottees may have to submit the equivalent quantity of shares for eventual annulment. Additionally, levy of penalty and fines may well come into play.

All of what I have stated is based on my perspective only, and I could be way off the mark in my thinking.February 25, 2024 at 5:32 pm #27561LoganRegistered Boarder@odysee, I agree with you but at the same time we have to look at how things were handled in the past too. SKR is someone who will be ready to drag things and will be least bothered about others. I supported his decision on Lycos because Lycos was not worth that much, it was more to do with perception than the actual survival of the company but the recent events can’t be dragged and now it’s actually about the survival of the company (and of course the perception too). He could’ve appointed interim CEO and CFO and a chairman at least but he’s not willing to do that because that’ll cause him to lose control. Shareholders badly need leadership in the company now but it’s been 5 months since the SCN2 came and still there’s no actual progress.

We were about to see growth in standalone numbers because of the audio ad business and the recent disruption in technology because of AI would’ve been an advantage to the company but all that will be gone because there’s no leadership in the company. I think the audio ad business is dead and maybe the US subsidiaries too because of SKR’s absence. My only hope is OMS and if he does something to that then there will be no hope left.

I don’t know much about Securekloud’s events but I think they appointed a new chairman and CFO immediately after the CEO/chairman was removed in 2022 but look at the progress in BCG. I don’t support SKR coming back and I’m not supporting Securekloud too but BCG could’ve followed the same path so that shareholders wouldn’t have suffered.

February 28, 2024 at 11:56 pm #27576vstvmRegistered BoarderHi everyone,

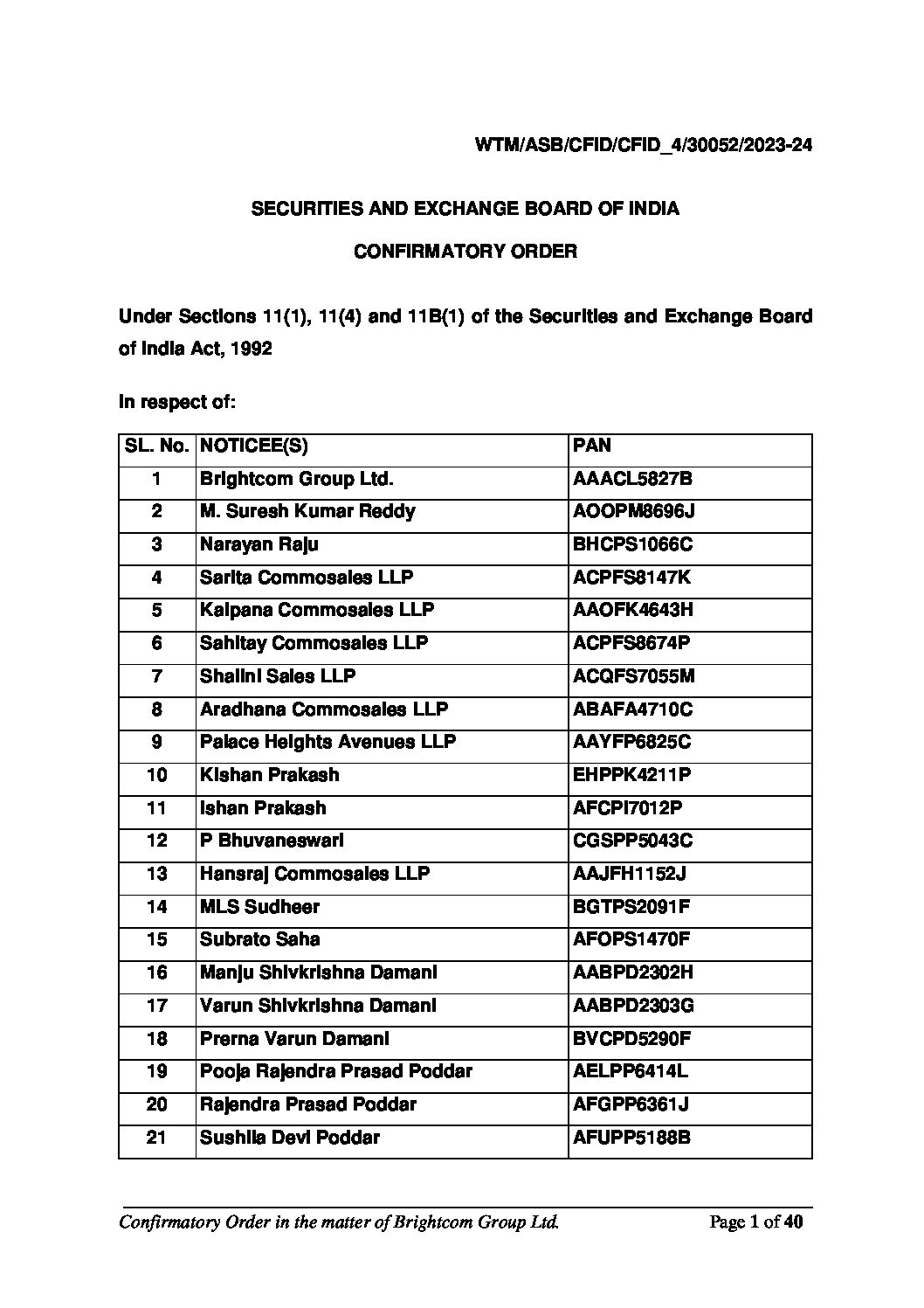

SEBI final order has been issued it seems, is anyone aware of it.

I am trying to trace the order, but unable to find it.

Please check and share if anyone finds it.

Thank you.2+February 29, 2024 at 1:00 am #27577vstvmRegistered BoarderHallo everyone,

I found the SEBI confirmatory order dated 28-2-2024.

Raju CFO released.

Shankar Sharma released.

SKR debarred from holding any position.

Please read and provide your insights.

Thank you.Attachments:

February 29, 2024 at 3:07 am #27579LoganRegistered BoarderAll the observations are related to misdeeds of SKR and as of now SEBI hasn’t complained about the financials of BCG. Like I’ve said many times before that BCG was (and being) run like a private company, SEBI has also made the same observation. Giving one man all the control is never a good idea (unless it is Warren Buffett). All these years there was never a board actually and it was only SKR.

The acts of SKR shows utter disregard for rules and regulations and his careless attitude. He never cared for shareholders as any idiot would’ve known that he couldn’t get away with these stupid things. I think most of the loans were taken for SKR’s personal use and since he couldn’t pay back, he gave away BCG shares for free not giving a damn about shareholders and their hard earned money. We are paying the price for his crap. Sorry for the language but that is what I feel. He could’ve taken crores of rupees as salary and paid back his personal loans but he never wanted to harm the subsidiaries and he used the parent company only for his selfish uses. Not even a single shareholder would’ve complained if he took crores of salary but he messed it all up. In all this, only his friends made hundreds/thousands of crores but the shareholders who trusted him through thick and thin are suffering the most.

SKR will continue to fight as guilty people will rarely agree to committing fraud. He’s falling and dragging the company along with him.

Now the board has 2 options – one is continue to be SKR’s puppets and don’t resolve the issues for years and let SKR drag the company down along with him and the second is come out of SKR’s control, focus on clearing his mess and continue to do business and concentrate on protecting shareholders’ interests and doing the best for shareholders.

I supported the SKR who built the company from scratch with hard work taking wise decisions like buying OMS and starting Brightcom but I’ll never support the SKR who cheated and back-stabbed shareholders for his personal gains and who takes stupid and reckless decisions without caring about shareholders. How could he do all this without shame and call shareholders his family? No one will treat their family like this. Like I’ve mentioned before, I’d rather die than put my family in this position.

All these are my opinions/observations and I maybe completely wrong, please don’t consider my opinions for buy/sell decisions.

March 5, 2024 at 4:44 pm #27602RajRegistered BoarderResults update by new mgmt. Hope the nos are true.

Attachments:

March 6, 2024 at 1:58 am #27604LoganRegistered BoarderThis is a good development but not sure whether it came from the heart or came considering the circumstances.

Mr.Kallol Sen and the board had updated us 3 weeks back that they’d share the results and updates with us and they did it in 3 weeks and this shows that it came from the heart.

But this also came after the recent SAT event (yesterday) so the update from the management might be because of the circumstances and might not have come from the heart.

If it’s the former then it’s really commendable and shows that Mr.Sen does what he says and is committed and trustworthy (too early to say though) but if it’s the latter then it shows that he and the board are not really committed and there’s no improvement since he came on board.

From now onwards I want them to have these three important things – honesty, commitment and empathy. Let Mr.Sen, the board and the employees take tens/hundreds of crores salary/compensation if they do things honestly. No one will complain if they do that but they should not cheat or back stab shareholders and they should comply with all the rules and regulations.

Regarding numbers, Mr.Sen and the board are well aware that the whole country is watching them and I guess they’d not have shown fake numbers but if they did show fake numbers then they’re not only stupid but also evil.

March 6, 2024 at 10:44 pm #27606odyseeRegistered BoarderWe will know within the next two or so weeks about the authenticity of the numbers as the statement mentions that the limited review by the statutory auditors should be concluded in this time frame. I doubt if the numbers are fake as these must have been presented to the auditors for their limited scrutiny.

As regards the timing, I believe Mr Sen would have been absolutely clear that he must honour his commitment made in the very first letter signed by him and submitted to the stock exchange a little over 3 weeks ago. There is no percentage in starting his innings on the wrong foot.

I also doubt that the scheduled SAT hearing had anything to do with this as it was widely known that the Judicial Member’s vacancy had not thus far been filled, and hence the hearing would be deferred.

Let us keep our fingers crossed for a consistent display of honesty, commitment and empathy as expressed by Logan. And a sincere and dedicated attempt to be transparent and responsive to shareholders’ concerns and expectations.March 7, 2024 at 9:57 pm #27612whity3187Registered BoarderAccording to my price analysis, the chart of BCG is looking very bearish. I don’t want to say the target here.

4+ -

AuthorPosts

- You must be logged in to reply to this topic.