Tagged: sahabatqq

- This topic has 5,565 replies, 167 voices, and was last updated 1 week, 1 day ago by Longplay55.

-

AuthorPosts

-

April 14, 2023 at 5:32 pm #25930chrisRegistered Boarder

Either way, from what I’ve understood sebi is claiming that the management has used asset write off in a way that PnL wasn’t affected, to show a rosy picture in order to dump promoter shares at a higher price and profit of it. Then issue warrants at a low price to regain promoter holding.

From all this, what I have understood is that the promoter holding decline is the bigger question and problem.

So as per the change in rule, regarding pledged promoter share declaration in October, 2019. Transfer of shares once pledged have to be removed from the promoter quota and this was the major non-compliance.

Any other views please do share.

8+April 14, 2023 at 6:07 pm #25931akkithegrtRegistered BoarderYes, I agree with @vgsatwork.SRK should be thrown out for playing with the sentiments of retailers.

We should demand new management for the betterment of the company.

SRK’s degree should be cross verified, is he really IITIAN or a scamster.

FPI, Shankar Sharma, and we the retailers should demand new management.The investor who got shares now(pending from 5th and 6th dec)should go against sebi in court bcs the price difference comes out to be of 20 rs or nearly 50-60% down from what they should get.

April 15, 2023 at 11:38 am #25932BrightspotRegistered BoarderSory for my previous message, definitely its not end of the world, SKR can take this opportunity to strengthen his balance sheet and corporate governance by hiring professionals from good industry, rather recruiting people from unknown companies

Royal orchids also got similar interim order in the past with multiple allegation but its investors did not panic, it reacted only one day , but later company came with many good news and stock rallied, SKR should come with good news like Daum settlement to cool down these panic souls and respect the timeline provided in the reportApril 15, 2023 at 11:41 am #25933NIRAJ1Registered BoarderFew comments for FA reports of BCG.

NOTE: My intension is not to save SKR or BCG’S MANAGEMENT. This is for discussion purpose.

1.AUDIT REPORTS.

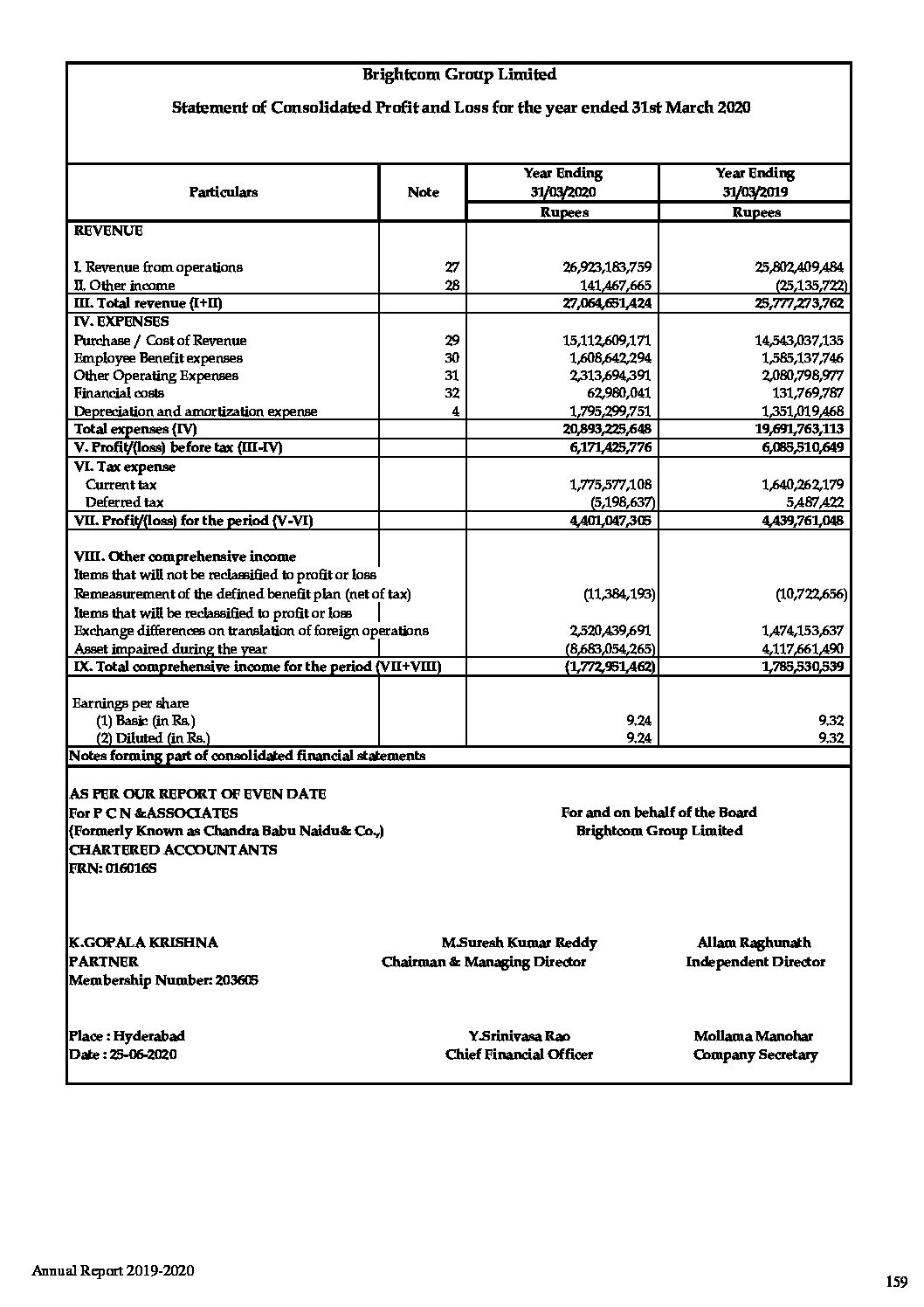

.Below excerpt, taken from audit report. Main objective of accounting manipulation was to take stock price higher and dump promoters shares. This is a planned fraud of top order.

“..The accounting irregularities, due

to which the Company could paint a rosy picture of its financials, can be said

to have impacted the decision-making process for all stakeholders including

public shareholders of BGL who were oblivious to such accounting

irregularities. It is also worth noting that during the investigation period, the

promoters’ shareholding in BGL decreased from 40.45% on March 31, 2014

to 13.96% on March 31, 2020 and further to 3.51% as on June 30, 2022. The

promoters thus offloaded shares at prices which were artificially propped up

by showing higher profits through accounting irregularities.My understanding is –

BCG has done so many accounts errors/mistakes and violate SEBI’S norms.

What I understand that it is account methods that was different from SEBI’S recommended.

• Is it correctable? Yes .SEBI has ordered it.

• What is financial implication?

• Loss will be shown of around 400crs in FY 19-20 due to impairment.(450-850cr= 400) approximate.

• IF BCG has shown in every year from FY 14 TO 20, It would be average around 100cr per year.

So over all profit will be reduced by 100cr on and average. So EPS would reduced by 2 every years.

• What was price of shares from 2014 to 2020 march.?

In 2014 price was maximum 28 RS and down to 3-4 Rs in 2020.

I don’t think that promoter had pump and dump the shares at very low valuations.

• What is remedy?

To do re audit of all accounts from 2014 to 2020.

See actual profit on page no 16 of reports. They had mentioned 4 possibilities but none mentioned that BCG has made loss. Please go through that page.• All the four possibilities are given in the Table below:

Annual Consolidated figures for the financial years (INR Lakhs.)

Particulars Total Prior to 2014- 15

Investigation Period 2014-15 2015-16 2016-17 2017-18 2018-19 2019-20

Reported Profit Before Tax 52,199 60,013 61,901 59,035 60,855 61,714

Reported Profit After Tax 34,222 40,505 42,924 40,700 44,397 44,010

The FY wise break up of expenditure wrongly recognised as “Other Current Assets”: As per data Set 1 – – – – – 50,449.71 – 50,450 As per data Set 2 – – – 11,533.79 14,003.37 25,015.87 – 50,553 As per data Set 3 In absence of detailed breakup, individual mapping of the impaired asset could not be carried with the recognised assets and hence it could not be ascertained in which year the impaired assets were initially recognised.

As per data Set 4 1,964.74 11,399.78 7,010.24 12,208.81 8,037.69 9,007.69 1,065.93 50,695 Profit Before Tax if correct accounting treatment was followed:

Data set 1 52,199.00 60,013.00 61,901.00 59,035.00 10,405.29 61,714.00

Data set 2 52,199.00 60,013.00 50,367.21 45,031.63 35,839.13 61,714.00

Data set 3 Not Ascertainable

Data set 4 40,799.22 53,002.76 49,692.19 50,997.31 51,847.31 60,648.07Profit After Tax if correct (Ignoring Taxation impact)

accounting treatment was followed:

Data set 1 34,222.00 40,505.00 42,924.00 40,700.00 -6,052.71 44,010.00

Data set 2 34,222.00 40,505.00 31,390.21 26,696.63 19,381.13 44,010.00

Data set 3 Not Ascertainable

Data set 4 22,822.22 33,494.76 30,715.19 32,662.31 35,389.31 42,944.072. About Share holding patterns

I don’t have any explanation of reduction of share from 41% to 33%

Company had diluted share holding from 33% to 18% due to preferential allotment.

Company has pledged or transfer shares from promoter to pledge company off market. That is foolish step. Price of shares was RS 3-4 in march 2020. Pledged company had sold in open market later on. Now SEBI has given clear cut guide lines. SKR cannot do much unless he purchased shares from open market from money he got for pledging/ transfer.3. DISCLOSURE:

Management is very poor in disclosure and we repeated said in conference. SEBI has taken this point very seriously. They should fine them. Like results from FY 2014 TO 2020.

4. NEW AUDITOR

BCG should appoint new auditor like E&Y.

Once everything get cleared BCG will show it full potential. I could find money manipulation or Fraud in any reports.NIRAJ PARIKH

16+April 15, 2023 at 2:42 pm #25934T9CRegistered BoarderI think this is final report as per below point.

Attachments:

3+April 15, 2023 at 3:16 pm #25936anand84sharmaRegistered BoarderTreatment of impairment of assets in the books of account of Brightcom Group Ltd and Vedanta Limited during the financial year 2019-2020. As per my knowledge in both type of treatment of impairment of assets( as per brightcom group and Vedanta Group)

under statement of Profit and Loss no issue of tax refund or excess tax paid because if impairment of assets is taken as expenses (as per Vedanta Group which is right presentation as per Indian A.S) in computation of income this expenses is added back with Net Profit.(due to non deductible expenses)5+April 15, 2023 at 4:44 pm #25940vkhare789Registered Boarder@T9C

You are right. This seems to be the final audit report.2+April 15, 2023 at 10:07 pm #25941VALUEBUYER001Registered BoarderVkhare789,

This is just show cause notice for which company is to reply, respond, act as per deadline.after some time final fa report can be expected3+April 16, 2023 at 8:22 am #25942SobhaRegistered BoarderFrom the forensic audit report it appears that the regulator has upheld the audit report of some subsidiaries, which are generating 75% of revenue and profit. The auditing was also done during the period the promoter was selling his holding. During that time the EPS of the company was above Rs 8 and peer PE at a global level was much above 50. By publishing the audit report during that period the promoter could have sold his shares at Rs 300 or more per share. But he has resorted to selling the shares for 3 – 4 rupees (Bonus adjusted). What is the explanation for this?

The preferential warrant was allotted almost at the same price. So it cannot be shown that the promoter made a huge profit in that.

It was the period the court case with Daum was going on at the New York Court. The management has a vested interest in under-stating the profit and reducing the share price in order to show to the Court that there was no profit to pay for Daum and the promoter holding in the company is less than what the Daum is demanding. At the all time low, the market capital of the company was near 110 crores (47 crore shares with price of Rs 2. 25) and the promoter net worth in the company was nearly 45 crores(40% holding) which was much less than the demand for 280 crores by Daum. There emerges some probabilities regarding the share selling. It can be that – assuming that the case will go to the Indian Court, the promoter has transferred his shares to some binamis. Another possibility is that some financial institution has trapped him and acquired the shares in the above process. It was a time when a group of FIIS which were earlier invested in the company were in a hurry to exit. It can be that the promoter tried to reduce the share price in order to push them to sell at a lesser price.

The pledge story has come to the fore after the forensic audit was initiated. It can be assumed, that was for giving an acceptable explanation.

April 16, 2023 at 10:58 am #25943chrisRegistered BoarderThere was a mention of this group in a call held by beatthestreet, where an individual was asking the moderator if this very group was mentioned in the audit.

The moderator did a great job by saying information that is given out has to be assessed and investment has to be made accordingly, but I don’t understand this, this group has been active since 2016-2017, when share price has been crashing, what was shared was info regarding business, business model, corporate governance etc. there was a weird accusation at one time where LOGAN was accused of being SKR himself ?.

When times are good there is no mention of this group, when times are bad this group comes to the forefront and theories that the company in question uses this group to mainly trap the “innocent retailer”.

Just ridiculous. But again the analysis done by beatthestreet was good mainly covering the interim order, with one guy Mayur talking about the business of brightcom and how to validate the alleged clients claimed by brightcom.

April 16, 2023 at 11:39 am #25944April 16, 2023 at 11:59 am #25946akkithegrtRegistered BoarderMayur spoke with facts about business as it is genuine, but so did the beatwithstreet host spoke on CG of the company.

what should be the next step for BCG to build the repo again?

I can see the only thing that can build the BCG repo is, throwing out SKR and closing the NCs as per the SEBI timeline.

Let BCG be taken over by some professional management.SKR is a fraud and should be thrown out of the company. Fraud because he lied on SHP and he lied on daum issue. What is the guarantee that next time he won’t lie?

BCG still has a bright future left, but only when professional CEO is running the company, not SKR!

April 16, 2023 at 9:19 pm #25947BrightspotRegistered BoarderBig relief, Mr shankar sharma broke his silence on BCG..he tweeted this

Let’s be clear: compliance & reporting are extremely important things to give weightage to, as Investors & the SCN rightly points out lapses on this score.

BCG 100% needs to ensure that never ever does it have any such issues.

On the veracity of the global accounts ( Sales, Profit, Cash, Global Tax paid), the SCN doesn’t seem to have any allegations.That’s a HUGE relief for all investors in the company, big & small.

Once accounts are restated showing impairment via P&L, that issue gets addressed.

(That said, investors don’t consider non-cash charges while calculating ” real EPS”. We look at regular operating PAT for this. This concept is called ” Proforma EPS, globally)

Let’s hope BCG management takes this situation as an opportunity to fix its shortcomings. Hard reforms usually happen in crises.From what one can see in the SCN, problems don’t seem insurmountable.

(Lastly, Good thing is that it’s a debt -free company, so liquidity & solvency aren’t an issue. )

April 16, 2023 at 10:13 pm #25948vkhare789Registered BoarderApril 16, 2023 at 11:12 pm #25950LoganRegistered Boarder@chris, there are many types of investors who have different views, one group says that the market is always efficient and that it can never be wrong, one group says that the market is not always efficient and that it can be wrong frequently, some people think that they know (or can know) everything about everything, some people think that they can know everything just by looking at the prices of different stocks, while other groups think that they can never know everything about everything and try to research and analyze as much as they can.

Legendary investors like Warren Buffett, Howard Marks, Ben Graham, Charlie Munger etc say that the market is not always efficient and it can be wrong many times. Ben Graham said that “The stock market is there to serve you and not to instruct you” which was repeated by Warren Buffett. Also, Warren Buffett wrote something similar in the recent shareholder letter.

“One advantage of our publicly-traded segment is that – episodically – it becomes easy to buy pieces of wonderful businesses at wonderful prices. It’s crucial to understand that stocks often trade at truly foolish prices, both high and low. “Efficient” markets exist only in textbooks. In truth, marketable stocks and bonds are baffling, their behavior usually understandable only in retrospect.”

Today Mr.Shankar Sharma mentioned this in one of his tweets – Market is not always rational or logical. In fact, rarely so. But we must strive to be.

I subscribe to the above thought and will say that the market can’t be right all the time and everything looks easy in retrospect. Before talking about others, personally I also know that I can’t be right all the time and making mistakes can’t be avoided. Whoever says that they are right all the time and can know everything about everything is not just fooling others but they are fooling themselves. A broken clock can be right twice a day and they focus only on those two times ignoring the rest of the time when they were completely wrong. Last year when the forensic audit news came, it was easy to guess where the price would go until the audit was finished. Some “experts” took that obvious point and projected themselves as heroes.

I support the CEO or the management on things that they have been good at and criticize them on things that they are bad at. I’ve never supported the CEO on corporate governance and in fact I’ve always been critical of the company on that part. I have criticized the CEO on corporate governance, investor relations and communication, disclosure part more than any other person. I’ve supported him when it comes to the business part of the company.

There are 3 main observations of SEBI in that report, the first is related to impairment, second is the SHP, and third is compliance, disclosure related. All 3 come under corporate governance, especially the second and the third points. I or anyone can’t say SHP, communication, investor relations or compliance all the time and we mention corporate governance instead because all those come under that.

What some people want is that they want everyone to be like them and criticize the CEO or the company on all aspects, its either yes or no for them and there’s no middle ground. I can’t criticize or hate someone just for the sake of it. Nowadays I’m not sharing my views or writing frequently because of 2 things, one is my health issue and the other is that I don’t want to argue with someone and become their enemy. Suppose I support the CEO or the management on one topic and criticize him on other topics, some people will concentrate only on the first part and completely ignore the second part and they hate me for that.

When it comes to self-proclaimed experts who know everything about everything and who are active on social media, ask them about BCG and they say that the biggest issues are the name changes of the company and BCG subs not being audited. The second part is addressed by the forensic audit report and also the company has shared the audited results (not completely though). Regarding the first part, they don’t even understand why the company changed its name few times. USA Greetings was a publisher which had content and when the company moved on from that and started back-end services, it couldn’t use USA Greetings because people would’ve thought it as a greeting card company which will be a publisher or as a content provider and not as an advertising network company and you will be limited to working only with greeting card companies (online greetings card that is and look at the growth of adtech vs online greeting card business). So, they don’t want the company to focus on its future, business and moving into a business that has tremendous future but want it to stick with the declining industry and go out of business just to keep the old name. And these people are supposed to be good at everything and have the best judgement.

And when it was changed to Lycos, that time the Lycos brand was bigger than Ybrant and you could get more clients. Even though Yahoo was acquired twice and at one point renamed to Oath, after it was bought by Apollo, it was renamed back to Yahoo because of the brand name. Yahoo is still active and big in adtech and people will recognize Yahoo more than they recognize Oath. Coming back to BCG, before Lycos case final verdict had come, BCG had started Brightcom (concentrating on the futuristic programmatic advertising) and most of its brand was changed to that or came under that and after the final verdict came, it had no choice but to lose Lycos and give up that name. It either had to rename itself as Ybrant (which brand the company was using less) or use Brightcom name which got traction and popular in the adtech industry? The answer is simple. There are many instances where companies have changed names for various reasons and you can’t call them fraud or fake just because of that.

Self-proclaimed experts know everything about everything, any topic you mention, they’ll tell you the history, mystery, future etc and they know everything about all the industries more than experts or people who have worked in that industry for decades but when it comes to basic common sense, they can’t understand what’s going on. How can the company keep Lycos name and not change its name when it no longer holds Lycos and when it was directed by the courts to give up Lycos? Will DAUM be okay if the company makes money using DAUM’s subsidiary name? Will the courts allow it? Won’t DAUM sue the company if the company refuses to give up Lycos name?

Also, more importantly, everywhere BCG mentions that it was previously named/known as Lycos Internet. In the annual reports, other documents etc they mention that they were previously known as Lycos Internet Ltd. Why would a company who’d want to hide their past by changing name want to mention their previous name in everything and everywhere?

Genuine investors research about companies for months or years but our self-proclaimed experts do it in seconds just by looking at stock prices and name changes. Investors should be careful when they follow self-proclaimed experts, not just for BCG but any other stock/company. There are some people who come with biased view without even understanding the basic concepts. If anyone has any problem then they should talk to managements of the companies they have invested in and if they don’t respond then they should approach SEBI or the exchanges.

April 17, 2023 at 7:01 pm #25951akkithegrtRegistered BoarderApril 17, 2023 at 8:27 pm #25952vkhare789Registered BoarderI got SMS in morning that haircut in BCG will be increased to 100% by Apr 20th which means that there wont be any use of share pledging and shareholders wont be pledging their shares and which will reduce pledged %. Should be a good thing for shareholding pattern.

6+April 17, 2023 at 9:14 pm #25953NikhilrajRegistered BoarderApril 18, 2023 at 8:11 am #25954ramganesh1982Registered BoarderI wish the promoter understands the implications of not having proper corporate governance. A seperate team was established by him for taking care of updates and corporate governance but nothing happened in last 1 yr even after forming a team . He assigned a separate team for daum and nothing happened on that as well (i dont know when this non-sense started .. i took the stock in 2019 and this problem was open even then and I guess it’s there from SKRs birth time 🙂 ) . I see 3 major problems with this company

1) SKR as a promoter never walks the talk . Which is very important for big investors

2) There are too many loose threads which needs to be tied at the earliest and have been pending for a long time without any action taken

3) Don’t know why the SHP has to be kept secretive by the promoter ?? Either some cheats will do that or a person who wants to take over a company through the backdoors will do that . What is stopping him from exposing or disclosing proper details in public is strangeAll together he has messed up 2 things

1) Respect for the company from investors (self inflicted wound)

2) Value for investors for their investment over a long period of timeI don’t know if he has made money indirectly as claimed by many but i get my suspicions at times mainly due to these reasons mentioned above . Why would someone do all idiotic things when they believe that their company is one among the top 3 or 4 ad-tech company in the world ? ???? (Big perplexing question) ..

All the best for other fellow investors . I hope this chaos settles and we end up on the good side of the road ?️

April 18, 2023 at 10:34 am #25955NIRAJ1Registered BoarderANOTHEER TWEET BY

Shankar SharmaAbhishek, you are absolutely entitled to say anything you wish. But, most respectfully, nobody marketed this as some “decadal opportunity”, to the best of my knowledge separately,

if you do indeed read the SCN, it says impairment charges should have been charged to PnL, hence the alleged ” overstatement “.However, all Investors disregard & look through such non recurring, non cash charges, while calculating correct PAT ( it’s called Proforma or adjusted PAT & EPS). These impairment charges were always disclosed in its balance sheet, if you see FY19-20 numbers. So not ” hidden”.

So, net worth gets written down in both cases, hence, net result is same.

(Of course , there are many lapses on compliance pointed out in SCN, all valid and must be fixed ASAP. )Lastly, as minority investors, everybody gets the exact same data, and nobody gets more information. Each investor interprets the available information through a ” glass half full” or ” glass half empty” lens.

Lastly, the Audit didn’t find anything adverse in its sales, operating ( excluding XO charges ) profit, on a global level. Just FYI.

Debate is always good in investing, in any case.

12:06 PM · Apr 17, 2023

·

I believee that all problem can be corrected and BCG will came out with bright future… Now Managment should be proactive and solve all probelm mentioned in report. I belive this not fruad but accounting mistake.. -

AuthorPosts

- You must be logged in to reply to this topic.