- This topic has 5,397 replies, 166 voices, and was last updated 39 minutes ago by Logan.

-

AuthorPosts

-

June 7, 2022 at 10:18 am #14065LoganRegistered Boarder

There’s this company called Man Industries and sebi has initiated forensic audit of that company too. Sebi sent notice to the company in October or November but the company informed the market last month (May 9th or 10th).

There’s no news about this and nobody is writing anything negative about this company and this news didn’t have much impact on the stock price too. It fell from 85 to 75 and then there was not much fall and it went straight back to 84-85 and is now trading at 81.

Man Industries management have said that they have given the auditors and sebi every available document, information and that they don’t have anything more to share as they’ve shared everything.

So it’s clear that sebi is okay with companies not informing the markets immediately and it will give companies time to give explanation. Companies will have to inform the market only when the audit is initiated. I don’t think sebi will reverse it’s decision and not do the audit and I guess once they send notice they will conduct the audit even if companies provide all the information.

June 7, 2022 at 10:38 am #14066BrightspotRegistered Boarder@Logon man industry did not send his CFO to home during FA, even kid can understand what could be reason for sending him during FA, market wont take such things lightly,

also all know that why bonus was issued second time just for sake of Shankar sharma and he told that it was issued for retail investors benefit, so as per my understanding nothing is happening in forensic audit, I’m sure that if you open case with SEBI they will reply to that saying FA is on hold. Conference call was very vague this time, only his friends were allowed to ask question..this is just my view7+June 7, 2022 at 11:08 am #14067LoganRegistered Boarder@brightspot, I just shared some information on forensic audit. I didn’t defend the CEO or the company and in fact I’ve been very critical of the company about the topics you’ve mentioned. If you check the queries that I sent, I have asked every critical question that investors may have. As investors we can’t do more than this.

In the recent conference call that Man Industries conducted, they just said that there’s nothing more to discuss as there was no update after the May 12th call (Man Industries had held a call on 12th to discuss FA).

What I’ve understood from seeing all the companies that were asked to undergo FA, once the audit is initiated, everything will be in SEBI’s hands and companies can’t do much about this.

Transcript of the recent conference call held by Man Industries (only this much was discussed about the FA)

Caller : And finally any update on the forensic audit after the last call that we had any reply or revert

from SEBI till date?Ashok Gupta (Man Industries): No further updates after that call of 12th May, nothing is there.

This is similar to what Sun Pharma people had said in one of the conference calls when people asked about FA.

June 7, 2022 at 11:27 am #14069Sumeshnair2005Registered BoarderHi everyone I know its difficult times but I feel dark can only uploaded shp once the legal formalities vif llp is done thn we will see increased promoters holding .. if u see nse every few seconds someone buying in lot of 1000 to 2000 retailers? Very unlikely very soon reversal hold on

June 7, 2022 at 11:43 am #14070hw_twRegistered Boarder@sac6310 – I couldn’t login to MCA portal due to some technical issues… Could you share either a screenshot of it or a high level details of SKR and other Promoter holdings

June 7, 2022 at 1:38 pm #14072BrightspotRegistered Boardersuddenly buy order of 25 lakh broke LC for sometimes ..hope LC saga ends today

June 7, 2022 at 2:06 pm #14073LoganRegistered BoarderI saw that too, there was some 16-17 lakh sell order before and after the 25 lakh buy order was executed these operators suddenly put more than 24 lakhs for sale. They are desperate to bring the price down. It would’ve come out of LC and maybe traded in green.

Increasing the free float by giving bonus has made manipulation easier.

June 7, 2022 at 2:10 pm #14074BrightspotRegistered BoarderWoW LC cant sustain for long , huge buy order coming every minute

June 7, 2022 at 2:37 pm #14076JackSparrow13Registered BoarderJune 7, 2022 at 2:55 pm #14077rahulRegistered Boarder@Brightspot I was the 4th person who got to ask the question. And it took me by surprise because I never got any chance, the trick is to be in call 10-15 mins before the scheduled time and press *1 immediately. You will be placed in the queue. At least this is what happened to me this time. So I don’t think the concall was staged. Though I had the same feeling when I heard the person name ‘Ishan’ getting to ask the question twice.

Pardon me if I did not ask any important questions. I am still new to this game. I thought promoter holding was the elephant in the room and I pressed a little more on it. And the second question about Free Cash flow to my mind seemed hard to understand. How can the number be exactly the same if it’s different from the operating cash flow? Coincidence? Perhaps.June 7, 2022 at 4:41 pm #14078chrisRegistered BoarderIt’s been a crazy day today, was looking at the timeline maybe inconsequential but wanted to share, at 1:04pm on a telegram group CI did mention today that with “22 lakh shares pending sell orders outstanding at the LC,his sell order of a minuscule amount of shares were executed before the 22 lakh share orders”, which continued onto a discussion of “ all or none, fill or kill “ orders.

At 1:32 pm the story started to unfold on BSE first and then everyone knows what happened.

So was wondering if the operator(if there is one) is following all these telegram groups and our forum as well. Might be coincidence as well.

But all in all it was a fun day!!One more thing, coming to timelines, even after the SHP was released on April 5 the stock did make a high of 108 three trading days later, so even if someone didn’t like the SHP (that includes me) they had time to exit near the all time high. But I chose not to and I’m the only one to blame for that.

I’ve been watching SKR for 8 years now, he’s been on every conference call patiently explaining to every investor even when BCG was trading at 5 INR, (and I know it’s his duty to do so). If the question of SHP wasn’t asked in the conference call I too would have called it staged.

But it all comes down to whether you believe in what he said, do you trust skr, ( I’ve been with the company since 2014, when it was trading at 60 INR, and the stock crash happened after the US division of BCG filed for bankruptcy in the DAUM case, and stock came down to 2.80 INR)

1. DAUM will be settled !!!

2. Forensic audit : on asset impairment(alone) which has been shared with the exchanges in 2020.

3. SHP: “nothing illegal” but cannot disclose more at the moment.These are all SKR’s words not mine, if there is an upward rally from here people tend to forget about the SHP and FA and all that. So dear friends in this upcoming rally (if there is one) remember to ask yourself these questions and take a decision accordingly.

MAY THE FORCE BE WITH YOU (and all of us)

June 7, 2022 at 4:47 pm #14079chrisRegistered Boarder@rahul has the company clarified the free cash flow question, have you received the “accounting answer” to that question from the company ?

1+June 7, 2022 at 6:07 pm #14080hw_twRegistered BoarderI can understand the delays in Items where things are totally not in your control … but for othe items management should have closed them quickly

This is giving a lot of room for the debate between both sides … On top of it management making statements against is adding fuel to these debates and daily one side or the other celebrating victory

For example items like these … (I am focusing only on the actual business leaving aside other governance related matters)

1/ Response to FCF related question … there is already a YT video stating FCF is not what SKR claims and is much lower at around 80Crs only

2/ MediaMint acquisition – there is no timeline yet to close this deal … In what was looking like a last step of just writing a cheque/ bank transfer this item is pending since last 3 months and there is no timeline yet … Not sure why this is not moving further

Request the management to close these kind of items quickly so that investors can get some confidence… otherwise investors, including long termers will find it difficult to digest all the negativity surrounding and would end up taking wrong actions unless that’s the strategy of management

June 7, 2022 at 6:29 pm #14081JackSparrow13Registered BoarderRegarding Mediamint issue, I was trying to search the reason.

Then I got this.The earlier promoter was alloted shares in April.

https://mobile.twitter.com/TusharSJadhav/status/1513859985960185863Assuming a few more “invisible” steps, i am assuming Mediamint’s results to be consolidated by September quarter (or Dec quarter at worst).

I am also very interested about when AGM will be held, and dividend credited. It was delayed last year I think. The reason is, I wonder who will pay dividend bill this year, Brightcom’s reserves or Mediamint.

June 7, 2022 at 7:43 pm #14082hw_twRegistered Boarder@JackSparrow13 – I am aware of this update… BCG shares were allotted to MediaMint sometime in Feb and we were expecting the Cash transfer to be done by end of Feb or by March …

But there is no update and there was no timeline given even in recent call in June which is surprising

We are not aware the delay is from BCG side or from MediaMint side.

Note that BCG is already mentioning it’s employee strength of 1700 people which includes MediaMint too

A simple update to the exchanges on the current status and target timelines would avoid any speculations spread across

June 7, 2022 at 7:52 pm #14083hw_twRegistered Boarder@sac6310 – I was able to get access to this document from MCA site.

The shareholder’s document (part of Other Attachments folder) was uploaded recently on 20th May … but it was actually an old document dated 31st March 2021 and not the latest one … It has around 66K shareholders only and wasn’t having names of Shankar Sharma or other recent allottes

Please let me know if you there is any other document which I can look into

4+June 7, 2022 at 9:28 pm #14084AbhishekRegistered BoarderFriends, it’s very interesting time in BCG, strategic acquisitions in progress, topline, bottom-line, FCF improving, debt free, and many more to happen in next 1 year. Let me remind you all, what SKR sir said in one of the AGM, before the rally started and before SS entered (I think between 2nd and 4th quarter of 2020-2021), that everything will fall in place and he/his-team should be able implement plan by Mar’2023 and so actual financials including SHP will reflect at that time in Apr’2023 or after. We should focus on financials and business, as long as both are good and improving then HOLD for long term and stay away from tweeter/You Tubers influence to get worried, frustrated and start doubting facts. And facts are what BCG shown outstanding results in FY 2021-2022.

June 7, 2022 at 10:11 pm #14085vstvmRegistered BoarderNew presentation uploaded in the bse portal, with financial guidance figures for 2023.

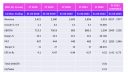

please check and provide your input friends.2+June 7, 2022 at 10:11 pm #14086chrisRegistered BoarderAnalyst presentation/Guidance report for coming financial year submitted by brightcom to exchanges showing a 40 percent increase in revenue 25-30 percent increase in PAT.

Attachments:

1+June 7, 2022 at 10:27 pm #14088 -

AuthorPosts

- You must be logged in to reply to this topic.