Tagged: sahabatqq

- This topic has 5,565 replies, 167 voices, and was last updated 1 week, 2 days ago by Longplay55.

-

AuthorPosts

-

December 30, 2020 at 9:19 am #9973RajRegistered Boarder

Odysee, this question has be to be answered by Skr.. Now everyone are looking up to him to finally deliver the goods. Action speaks louder than words. Action, action & only action. ?

December 30, 2020 at 6:44 pm #9980LoganRegistered Boarder@odysee, I don’t know about that particular index but in other indexes (indices), they see many factors like market cap, price of the stock (they’ll try to exclude stocks trading below 10), growth of the business, future aspects etc.

Recently in the Dow Jones index, giants like Exxon Mobil (before that GE) were replaced by modern companies like Salesforce.

With BCG, the good thing is that it’s in a growing industry. All the traditional advertising is shifting to programmatic. The market is very huge – global ad spend will be close to $700B in 2021 of which more than half will be digital according to eMarketer.

This doesn’t mean BCG will be recognised just because its in that industry, it all depends on execution and if the CEO takes good decisions then we can expect a turnaround story like Tanla. If the market cap reaches a certain level then many parties will be interested. Most of the fund houses look for stability so they try to avoid small caps.

December 30, 2020 at 11:07 pm #9981VALUEBUYER001Registered BoarderDecember 31, 2020 at 8:51 am #9984bhalothia9Registered BoarderDear @Rathi_b jee, if you can share some more information about your discussion with Mr SKR, it may help understand the purpose of the warrants. We thought share price is driven by market, however we have seen in last 2months that how it was controlled so that the warrants are approved. I hope this ping pong in BCG share price goes away now.

5+December 31, 2020 at 11:03 am #9985Rathi_bRegistered BoarderLet us wait for the SHP report for the quarter first, it’ll be out ina week. Let’s hope it sheds some clarity now.

December 31, 2020 at 5:51 pm #9986balajihandsRegistered BoarderBCG DREAM RUN 2021

1. Link Reference in the pic (https://www.bseindia.com/xml-data/corpfiling/AttachHis/ada21439-684c-44b2-bf64-f13ede53cbc7.pdf)

2. As a investor – chin up – spread positivity

3. snapshot attached

4. Disclaimer: This sheet is prepared for educational purpose only;

Do your own research/risk/analysis in your investment is strongly recommended————————————————————————

WEEK FROM TO NEWS START END

————————————————————————

1 18-Dec-20 24-Dec-20 DIVIDEND BUZZ 5.3 6.96

————————————————————————

2 28-Dec-20 1-Jan-21 AGM BUZZ 7.25 8.7

————————————————————————

3 4-Jan-21 8-Jan-21 Q3 RESUTLS 9.1 10.8

————————————————————————

4 11-Jan-21 15-Jan-21 SHP Pattern 11.3 13.5

Expectation of

AXIS NCLT Issue closure

————————————————————————

5 18-Jan-21 22-Jan-21 AXIS NCLT issue closure

Announcement 14.1 17

————————————————————————

6 25-Jan-21 29-Jan-21 Market Positivity

LOC Approved!? 17.8 20.4

————————————————————————

7 1-Feb-21 5-Feb-21 DAUM issue closure

Announcement? 21.4 25.8

————————————————————————

8 8-Feb-21 XX/XX/XX Just market driven!

MF Adding? Bulk?

AI Acquisition News 27 XXXX

————————————————————————balajihands

Attachments:

December 31, 2020 at 11:03 pm #9988LoganRegistered BoarderSimple way to make people understand the difference between profits and cash flows.

If any genius starts doubting the profits of BCG then please ask him/her this simple question-

You have Rs.100 with you and you decide to buy a share of a company trading at Rs.100 per share. After a year that share price goes to Rs.150. You don’t sell the shares and decide to keep it. Now the profit is Rs.50 but how much cash you have? Zero right? Does that mean your profits are fake?

You need to pay loans of Rs.10, how will you do it-you don’t have any cash. You have Rs.50 profit but why can’t you pay just Rs.10?

The only way to pay the loans is if you sell the share. Your profits will be realised only if you sell the share.

In businesses also, there’ll be profits but not all of that will be in cash. The above example is very very simple but as we know doing business is complex and involves many parties. Companies buy many things on credit, for some they pay instantly which impacts the cash flows.

With BCG, although it’s making profits, the company is not getting the cash from clients whenever it wants. Some profits are stuck in receivables, some are reinvested back into the business. If you want to continue business with a client then you have to agree to their demands and you can’t demand them to pay cash sooner. If you do that then you’ll end up losing that account.

December 31, 2020 at 11:19 pm #9989LoganRegistered BoarderContinued…

That doesn’t mean profits are useless – in fact profits are very important for many things. It is because of profits that BCG didn’t borrow external money for doing normal business. Without profits BCG’s business wouldn’t have sustained and we’d have seen fall in revenues and profits. It is because of profits (converted to cash) that BCG could pay off the loans (more than 250crs) without borrowing – All the loans were paid by using it’s own money.

Profits are very important for sustaining the business but you need cash/liquidity for growth or to pay off entire loan amount in one go or to pay for settlement with Daum in one go.

January 1, 2021 at 1:23 am #9990Diana HortonRegistered BoarderJanuary 1, 2021 at 8:31 am #9991Sumeshnair2005Registered BoarderExcellent explanation logan even new investers can understand .. iam sorry without ur permisson i hv copy pasted it on mc ..though dont know hw long it wil remain before deletion.. but its v useful to new investers.. can anyone repost it before deletion though iam not sure if reposting and starring prevents it from deletion

January 1, 2021 at 3:45 pm #9994VALUEBUYER001Registered BoarderJanuary 1, 2021 at 6:34 pm #9996VALUEBUYER001Registered BoarderJanuary 2, 2021 at 3:58 pm #9999Optimus Prime 06Registered BoarderDear members, please clarify my doubts

1. When will the preferential issue of warrants will be allotted to the concerned persons?

2. If already allotted, when will the management get the money from the allotted persons?is there any time duration?

3. When will the preferential alloted shares will add to existing equity shares?

4. If they add, is there any chance of reduction in current market price?

Sir,

Anyone, Please answer my questions..

Thank u4+January 2, 2021 at 8:23 pm #10001balajihandsRegistered BoarderTo add one more question

5. Max time period for preferential warrents could be converted is 18 months. Similarly is there any minimum lock in period from date of allotment ? Or free to convert anytime from date of allocation to 18 months ?Thanks

balajihands4+January 3, 2021 at 8:00 am #10002Srd.rdxRegistered BoarderMy understanding..

1. They have to pay 25% within 2 weeks from 26/27th December so effectively by 10th the company will have the partial money post allotment.

2. They can pay remaining 75% anytime within 18 months. It may be as early as next month.

3. Post they pay 100% , the shares will be locked in for 6 months from the date of allotment of shares.

Once step 1/2/3 is completed..the shares could be dumped to market or expect them to be transferred to some institutions.

It all depends on SKRs game plan..if credibility improves BCG is a buy even at 10-20-30-50 rs..it’s pretty cheap. But is the same shrewd tactics continues.. expect pump and dump.

And BCG remains BCji!One thing is very prominent.. Acquisition is on cards.as told by SKR in AGM but again v have witnessed many announcements without anything concrete!

January 5, 2021 at 7:54 am #10005buffetRegistered Boarderlatest share holding pattern is out on BSE.

2+January 5, 2021 at 8:53 am #10007buffetRegistered BoarderIt seems Goenkas are out of BCG. But who bought it ? Zaveri gang?

3+January 5, 2021 at 11:33 am #10013manas18goelRegistered BoarderSeems like possibly operators are hitting lower circuits now. Only a guess though

7+January 6, 2021 at 12:31 am #10034whity3187Registered BoarderToday was the largest number of shares traded and also the most shares delivered in the last 365 days. God only knows, what is cooking.

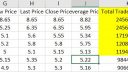

Attachments:

9+January 6, 2021 at 1:23 pm #10042LoganRegistered Boarder@Rathi_b, please don’t mind me asking this – why do you think the LOC is getting delayed?

We were hoping the company would get the first tranche by last quarter (Oct-Dec) but still there’s no update on that. Since they are getting cash by issuing warrants, do you think they’d still be interested in LOC?

-

AuthorPosts

- You must be logged in to reply to this topic.