Forum Replies Created

-

AuthorPosts

-

vgsatworkRegistered Boarder

Something doesn’t feel right looking at the Q3 results and I am not able to pin point. I am checking last 12 quarter data as published to the exchanges. will post the same post my analysis.

vgsatworkRegistered BoarderAnother flat quarter (Compared to Dec 2019 quarter) and slightly lower EPS on consolidated basis due to higher amortization & depreciation cost and equity dilution.

BCG’s software development business is degrowing like anything…

Covid 19 & US election driven top line growth is NOT SEEN in results…

vgsatworkRegistered BoarderIt has been two days and still there is no update about the hearing that was scheduled to happen on 10th Feb 2021 in NCLT between BCG & Axis case??

3+vgsatworkRegistered Boarder@Logan

I have always liked the analysis that data points that goes into your writing and that is an outcome of researching by spending time ane effort and I would like to see such messages coming from you which would be enriching. Do not take any comments personally. As I had mentioned earlier, all of us have invested, staying invested in BCG on our own accord and if our investments are doing great, we can either blame ourselves, we can blame the company, the management, but not anyone else@ rathi_b

Fully agree with your comment that we cannot let the CEO get away without being held accountable for the commitments that were made and not being kept up@Diana_Horton

There is so much of passion in your writing and I fully agree with you. We are cognizant of the fact we have been played by the management. All the reason for us to be vigilant and fight back. Else, no one else can safeguard our interest as shareholders.All problems gets resolved if there is sizeable growth.if there is significant growth, share price cannot be suppressed for long by operators. That is the underlying problem. If the industry peers are growing at 20-30%+ growth and BCG is languishing at single digit growth, then the problem is not with the company and it is squarely with the management and the way they conduct the business. In all of our collective interest, we need to call out a spade a spade and raise tough questions to the management. It may be sounding like shareholder activism. But, if there is no one else to do it, then we have to protect our own interest by fighting back or write down our losses and move away from this stock

vgsatworkRegistered BoarderMay be I am over thinking on this line. But why the Consolidation under one entity is not being actively pursued, especially after a public announcement on the same early last year? Such consolidation would have helped to get more affordable business loans as opposed to costly Account Receivable Financing?

Would moving out of large & institutional shareholders were triggered because the consolidation not being pursued and more costlier Account Receivable Financing was actively pursued by the management?

vgsatworkRegistered BoarderPer this article, Account Receivable financing could be done in one of the two ways

1. Asset Sales – Selling entire account receivable to a financier and avoid the default risk on account receivables. Upside is improved cash flow and default risk avoidance, etc. Downside is that the company may get only about 90 cents for every dollar of asset being sold to the financier2. Loan – This is more like a secured loan using account receivable as a collateral. This is easy to get and funding is upto 100% account receivables. But the interest rate and fees are substantially higher than a typical business loan. Large shareholders would be dead against this if the interest cost is huge and have a significant impact on the margins and my guess is that LOC in BCG case may have been delayed due to objections from large and institutional shareholders and now given that most of the large investors are out, company may go for the same..

Not sure what type of LOC that BCG is trying for.

Team at Hyderabad which has met CEO and were provided update on LOC – Can they throw more light on this?

3+vgsatworkRegistered BoarderCame across this interesting article in Investopedia about Account Receivable financing and thought of sharing with the group

https://www.investopedia.com/terms/a/accountsreceivablefinancing.asp#:~:text=A%20company%20just%20gets%20an,based%20on%20accounts%20receivable%20balances.2+vgsatworkRegistered BoardervgsatworkRegistered BoarderUpdate on the scores portal complaint that I made on 10th Dec regarding bulk deal by Zuber trading

– It is still Open in Scores portal – Looks like BCG has not responded to it yet though when SKR spoke to me I had asked him to put whatever he told me as the formal response and close it.

– From Scores portal, an entry seems to have been created automatically in NICEPlus portal of NSE earlier this month and they had reached out to BCG and the update there is that BCG seems to have responded back to them, but they reverted it back to BCG as there was deficiency in response and awaiting to hear back from BCG..vgsatworkRegistered Boarder@sobha

I am repeating the same point again. If indeed the PW is getting issued and the price increases by 10X or more, no sane person would hand the shares back to promoters for a peanut 10X profit where the shares are grossly undervalued compared to its peers, when they can sell it to a competitor for a much better price and a competitor company can get entry into BCG. Hence promoters might as well forget about getting majority shareholding, if indeed PW happens. If they are any smart, they would form a unison group and take control of the company. Since any sane promoter would not let that happen, one of these things has to happen1. PW getting shelved

2. PW allottees would sell their stake to a competitor paving way for a competitor company to take over BCG by making an open offe subsequently. This way PW allottees would get right price for their shares.vgsatworkRegistered Boarder#10581 @sobha

My take on this is as follows

If the warrants indeed get issued and if the share price is allowed to rise to 10X -20X of warrant issue price, why would any one of these 59 individual would want to sell it back to Promotor? No sane person would do that. Moreover if SKR wanted to accumulate all these shares by paying 300 crores, he could have done so even before some of these news flows came in. There was a period when stock was languishing between 2.5 – 3 rupees per share and he could have bought as much as he wanted, if he could have started buying in tranches (3-4% in a quarter) from then onwards and by now he would have acquired major stake.

Also, if the promotor has 300 odd crore personal money, they could have issued all these PW directly to themselves instead of issuing to these 59 individuals. There is nothing unusual about promoters issuing preferential warrants to themselves. Just like how they did not had any problems in getting this PW resolution voted in their favour, they could have got such proposal also passed easily. But then why they didn’t do it?

I believe promoter does not have personal money to buy preferential warrants or to buy from open market. What they are instead trying to do is to get all large investors systematically out of this stock so that it would have pure retail holding along except for promoters stake and that way they do not have to being in any additional money to gain management control. They would have management control due to the fact that no sizeable investor would be there to challenge their move. They can increase their shareholding later on through buyback offers wherein retail investors would get a decent exit. But till such time, they would try and control the price by controlling news flow is what I think…

vgsatworkRegistered Boarder@m4max1979 Ref#10555

Is it possible that LOC might have been rejected and that is why company is looking for equity capital?

Assuming that LOC is rejected, the route that the company has to raise funding is through equity. Either the Promotor can go for preference issue to themselves or the company could have gone for rights issue where all existing shareholders could have participated based on their current holding. But BCG has gone for Preferential warrant wherein only 25% of the PW money is guaranteed to be received and the PW allottees can wait for another 18 months before deciding to pay remaining 75% and get the PW converted into equity shares. That means company would have got only 65 crores which wouldn’t help the company in any way if it is trying to grow through infusion of money into the business. LOC would have been more in the range of about 70-80% their receivables (about 700 – 800 crore considering the outstanding trade receivables of 998 crore per the balance sheet as of sep 2020)

Since the above doesn’t make sense, we have to assume that the PW is NOT BECAUSE LOC is rejected. Moreover the last update that the company has given through the exchanges about LOC on 14th Sep is extremely rosy and if the LOC is indeed rejected, the management would have lot to answer for to SEBI for misleading the shareholders on LOC through official updates to stock exchanges.

Based on these points above, my take is that LOC is there for sure. They are just delaying getting the same for some reason. On the contrary, PW could potentially be shelved, if it was never meant to be issued at the first place and the news was more to scare and drive out existing large shareholders on EPS dilution fears, ensure that they cannot stand in the way of promotors decision (since Promotor holding is only about 36% now) – This is a possibility from my viewpoint and I am saying this only based on logic and the suspicion which I have indicated in one of my earlier posts..

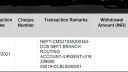

vgsatworkRegistered BoarderEven though I have received the dividend, something is bothering me. Sharing my views on the same..

Typically when the dividend gets credited, the transaction entry would have the details to indicate that it is dividend paid out by so and so company and this would be followed up with an email from the share transfer agent giving the details of the declared dividend, how many shares that you hold and how much is the dividend paid, etc. The payment would come through NACH (National Automated Clearing House). Here the payment is a specific bank transfer from a DCB bank account.

Bank message in BCG dividend case appears to be a NEFT transfer from a personal account and there is nothing in the transaction comments that mentions that this is the dividend amount for so and so share and there was no email from share transfer agent.

Also, attaching a email that I have got for dividend for one of my other investments, Natco pharma. I used to get a similar email from share transfer agent whenever I used to get a dividend for ANY of my other share holdings. There is no such email in case of BCG.

Definitely this doesn’t feel right. May be the company is trying to be secretive about the payment by making a bank transfer and not clearly stating the reason for the transfer, that it is a dividend payout. But, This is ideally something they should ideally boast of so that investors would know that they company pays dividend and one need not doubt the numbers.. I am not sure why???

5+vgsatworkRegistered BoarderI have my account with ICICI Direct and the amount has been credited to my bank account linked to my trading account by around 3 pm this afternoon

3+vgsatworkRegistered BoarderPlease refer to the disclosure on related party transactions by the company on 10th July 2020 to the stock exchanges. It clearly shows that the parent company has taken unsecured loan of well over 100 crores from it’s subsidiaries and is outstanding as of 31st March 2020.

So, it is not that they cannot borrow. They are indeed taking unsecured loans (If defaulted, the subsidiary company has no way of recovering it from the parent company)

vgsatworkRegistered Boarder@Diana Horton

I thought you wanted to keep the name anonymous and hence redacted in your screen shot. So I also haven’t mentioned the name in my post. They are doing commercial upscaling services (targeted for Start up and small scale companies) and getting venture funding into them and enabling easy entry/exit for investors in such companies

The company referred here is https://www.annlyz.com

vgsatworkRegistered BoarderI also got my dividend credited just now. It is working out to be 0.05*no of shares held by me *0.925 (after deducting 7.5% TDS)

Strange thing is that in the transaction information, company name or dividend kind of information is not being mentioned and it came as if some XYZ did a NEFT transfer from a normal bank account. I received dividends for some of my other share holdings and they ALWAYS used to indicate the detail as dividend and company name,etc

vgsatworkRegistered BoarderRed #10508

@Diana

I have actually gone through the company website that is quoting these testimonials. But one couldn’t say for sure as to what kind of services were availed by BCG from them. Also, the LOC is debt financing and what that company is helping with is getting equity capital to grow business.I am not sure if we can deduce anything for sure based on the same.

But I do agree with your view that Fund availability to Parent company should not have been a problem to close of Axis, As such they(Parent company) have been taking loans from their subsidiary (per the annual report) and nothing could have stopped them taking some more and pay off this debt.

vgsatworkRegistered Boardertrying to post it again since my previous post for whatever reason is not showing up

I have tried to go through the updates from BCG to stock exchanges in the past 1 year and made some observations and thought of sharing the same

Date of allotment of Preference share to Muskaan – 27th May 2020

Relevant date for preferential warrants – 27th Nov 2020 (Exactly 6 months after the allotment Muskaan – 26 week time period based on which the PW allotment price is being determined), even though the announcement of board meeting to discuss about preferential warrants was given on 1st Dec and the board meeting happened on 4th Dec. This 27th Nov is being determined as 30 days before the voting closure date of 27th Dec 2020.It is like precision clock work that some of these events happened on respective days

Another point to note is about Oak Exit. On 27th May when Preference shares were alloted, the SHP (published on 05th June)showed Oak had 3,33,68,913 shares. Exactly 3 months from there (by end of Aug), OAK was fully out. The share price on 27th May was 6.3 and on 31st August (when BCG informed exchanges that OAK has fully exited BCG)was 8.85. The max and min share price in this period were 11.95 and 6.05 respectively. BCG share has NOT been in this price range since Jan 2018 except for a very brief period of 1 or 2 days.

-

AuthorPosts