Forum Replies Created

-

AuthorPosts

-

jmathewRegistered Boarder

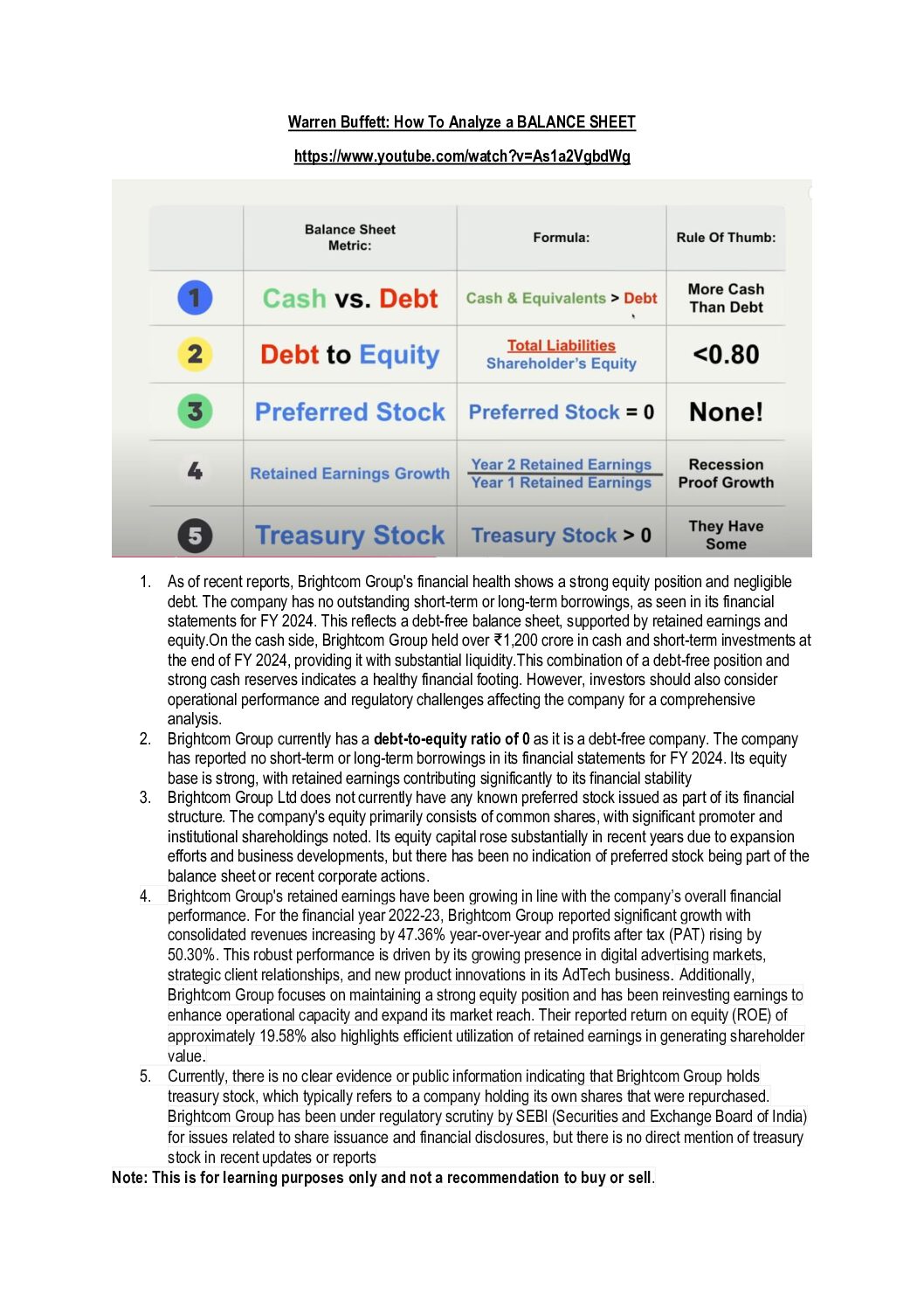

Warren Buffett: How To Analyze a BALANCE SHEET

jmathewRegistered BoarderBased on my research and understanding, I believe that SRK/OMS may have taken steps to obscure the actual revenue for Q3 and Q4. Additionally, they seem to have some kind of deal with 44 Ventures. However, the past is the past, and I hope SRK can recover and make a comeback. Ultimately, what we want is fair appreciation for our investments.

jmathewRegistered BoarderThe Trade Desk (TTD) typically uses a cost-per-mille (CPM) pricing model for advertisers, which means they pay for every 1,000 impressions. The average CPM on The Trade Desk varies based on factors like ad type, format, and targeting. Generally:Display ads have a CPM as low as $2.50. Video ads, especially mobile and in-app, are significantly more expensive, averaging around $9 to $11 per CPM Improvado Semrush The platform also incorporates a hybrid pricing model, blending CPM with a percentage of media spend (POM), where the most cost-effective option is automatically applied. This helps optimize costs, especially for campaigns with varying audience sizes or impression volumes Tunnl These rates provide flexibility for advertisers depending on their budget and desired reach

jmathewRegistered BoarderKey Factors Influencing Earnings Industry: Niches like finance, insurance, and real estate command higher CPMs (e.g., $30+).General entertainment or gaming tends to have lower CPMs.Geography: Audiences in developed markets (e.g., the US, UK) yield higher CPMs than those in developing regions.Ad Format:Video Ads: Higher CPMs (e.g., $10 to $30) due to better engagement.Banner Ads: Lower CPMs (e.g., $1 to $5).Native Ads: Mid-to-high CPMs ($5-$20).Audience Demographics: High-income, niche audiences (e.g., professionals, tech enthusiasts) generate better CPMs.Publisher Revenue (RPM)While CPM reflects what advertisers pay, publishers or app developers typically earn 50% to 70% of the CPM after platform fees. For example:If the CPM is $10, the publisher might earn $5 to $7 per 1,000 impressions

jmathewRegistered BoarderThe amount tech companies earn for 1,000 ad impressions depends on several factors, including the platform, ad format, audience, and industry. The revenue per 1,000 impressions is often measured by CPM (Cost Per Mille) or RPM (Revenue Per Mille). Here’s an overview:1. Major Platforms and CPM RangesGoogle AdSense AdX: CPM rates range between $1 to $10 for display ads. High-value niches (like finance or technology) can go up to $20-$50.Social Media Platforms:Facebook Instagram: CPM is typically between $5 to $15 for most advertisers. However, highly competitive audiences may see CPMs of $30 or more.TikTok: CPM averages around $5 to $10, but rates may vary by region and audience type.YouTube (via Google AdSense): CPM typically ranges from $3 to $10, depending on the content niche. Programmatic Advertising (via DSPs like The Trade Desk): CPMs average $2 to $15, but premium inventory can exceed $50.

jmathewRegistered BoarderAccording to the OMS website, they receive 40 billion impressions per month. Assuming a revenue of $1 per 1,000 impressions, their monthly income would amount to $40 million. Over three months, this would total $120 million. When converted to INR, this is approximately ₹1,000 crore. The actual number of impressions at present may be even higher.

3+jmathewRegistered BoarderFCF

Q1 205cr

Q2 216cr

Q3 92cr

Q4 pending receivable from Q3 (100 cr) + Q4 (200cr) = 300 cr

Total FCF q1+Q2+q3+q4=813cr

15% will be around 120cr.

So they may declare a dividend of a minimum of 50 Paisa.

Let us wait and see.12+Compare Jan 25th, 2022 SHP with March 31st, 2022 SHP

As of Jan 25th, 2022 SHP

Total number of shares – 1,18,16,83,124

Promotors holding -> 19.74 %

Institutions -> 11.55 %

Individual share capital in excess of Rs. 2 Lacs -> 17.69 %As of March 31st, 2022 SHP

Total number of shares – 1,21,07,53,124

Promotors holding -> 18.38 % (We all were expecting promotors holdings will be increased but …)

Institutions -> 12.09 % and increased to 14 % as per Sep 22 SHP

Individual share capital in excess of Rs. 2 Lacs -> 26.63% and 26.39 % as per Sep 2022 SHP (I think here is the catch. Why there is a sudden increase in this category, an increase of 9% within two months? I think maybe a major part of this belongs to the promotors group. Just my wild guess.There are lots of questions on SHP but we don’t have any way to get them clarified.

10+jmathewRegistered BoarderGDPR

jmathewRegistered BoarderBCG already released notification that they owing to the GDPR nomes.

SEBI need upgrade and study what is GDPR ( eu) and CCPA California

Thank to Mr.Vijay Anand for sharing these infoAttachments:

jmathewRegistered BoarderSome corection after a long run. I don’t think management will allow the MCAP to go below $1 billion . Hopefully we can expect q2 result in this month itself.

5+jmathewRegistered BoarderDear Brightspotji,

After the recent developments, it is just a matter of time for BCG to trade at decent pe. The market is waiting for the Q2 result and the name of the targetted company which BCG is going to acquire. US audio firm acquisition news is also expected very soon. At EPS of rs 8 ( forward-looking after Q2 result ), BCG should be rerated to a minimum pe of 20 by end of this year if not more. 4xfrom here is very much possible in the next three and a half months. Cheers.jmathewRegistered BoarderNumber of shares are increased to 74 cr. List is for investors with more than 1% holding.

Example promoters holding percentage is also reduced.jmathewRegistered BoarderTotal equity after bonus + warrants+ new issue of 12 cr shares = 116 cr.

Looking forward diluted eps will be around rs 5 from the existing business plus earning from the new acquisition. We can very much expect loc by end of this year which will add another 30 % . Few more acquisitions are expected plus new businesss

I belive we are on the way to non stop rs 100 plus, even all time high.

Average industry pe is 34 and I won’t be surprised if bcg move to pe 40 plus non stop.

Enjoy the ridejmathewRegistered BoarderjmathewRegistered BoarderInvestors, I just want to bring your kind attention to, few points from the conference call. I may be wrong so please do your research.

1. Please try to listen to the cc completely and try to connect all the dots.

2. SKR want to revisit for LOC after a quarter or two and before that, he is eyeing a good valuation

3. LOC will add another 30 % growth

4. SKR want a good valuation for the company before consolidating a few subsidiaries and QIP

5. He is looking for a sales target of $ 450 Million plus asap which will add more cash flow.

6. Few acquisitions are expected in the coming quarters.

7. He is looking for a famous J curve too (many after a couple of years)

As per my view, a minimum decent pe after bonus issues and PW dilution are around 20 (current sector pe is 34). Timeline – I expect pe 20 by end of this year. Best wishes to all the BCG investors.jmathewRegistered BoarderBCG’s eps, Rs 9 (FV 2), and Affle eps is Rs.50 (FV 10). If we split Affle FV to Rs 2 then EPS per share will be 10 and the share price is rs 950. So BCG with eps 9 trading @ 16 and Affle with eps 10 tradings at rs.950. BCG is present in many countries and much bigger than Affle. Bcg’s next stop will be at its book value. I expect many investors will shift from other stocks to BCG and will be able to make a multifold returns. Loc and audio firm acquisition news are expected at any time. 85-90 % of the shares are with Top 2000 shareholders.

Note: This is not a buy or sell call. Please do your research before investing.jmathewRegistered BoarderNoticed that more than 25 cr shares are traded in th last 3 months. Average delivery around 60 percentage. Seems like many weak hands are exited and probably majority of sgsres are gone into the kitty of needy.just my view only. Looking forward for a closing above rs 13 next week.

jmathewRegistered BoarderJust my view below I may be completely wrong.

1. PW investors accumulated more during the last few months with the help of operators and management

2. PW investors paid 25% so both of them met their requirements.

3. Management cannot continue with the price suppression as the time is running out for them.

3. They need to release the news on pledge share release, LOC, Daum closure and audio firm acquisition

4. A good full year result with decent dividendSo the up move started prior to the good announcement

It is a joke to see that 400 CR profit making global digital firm’s market cap is at 500 CR where it suppose to be minimum 15K cr to 20K cr market cap

cheers and best of luck. -

AuthorPosts